This blog first appeared on the Bloomberg Businessweek website.

“Generalist species is able to thrive in a wide variety of environmental conditions and can make use of a variety of different resources. A specialist species can only survive in a narrow range of environmental conditions.”

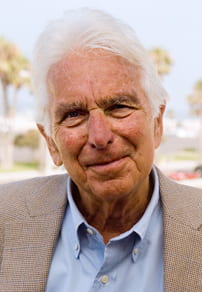

– Warren Bennis

When I was president of the University of Cincinnati in the 1970s, the dean of the medical school poignantly remarked that the only generalist he could find at the hospital or in the faculty was the patient. That irony has come to mind frequently in the past year or so when I learned that 60 percent of U.S. MBA programs reported a decline in applications. At the same time, according to Bloomberg Businessweek, “the market for specialized master’s programs in accounting, management, finance, and a number of other business disciplines has never been stronger.” Deborah MacInnis, a vice dean at the University of Southern California’s Marshall School of Business, has been concerned about these specialized degrees and alerted me that for the last five years or so, B-schools have received a growing number of applications for these programs. And many of them seem alarmingly esoteric or vocational such as smart grids, luxury management, fluid dynamics, hospitality, insurance, and retail.

It’s not the esoterica or the “trade school” emphases that concern me. It’s the specialization. The original and brilliant idea of an MBA was the opportunity for students to study the theory and application of business and management principles. The primary goal of management education was, as originally conceived, to impart knowledge that could be applied to a variety of real-world business situations. That remains starkly true to this day when the need for “deep generalists” on the faculty, for our students and professional clients, is more essential than ever. By “deep generalists,” I mean faculty grounded in one discipline who connect and collaborate with others: computational biology, neuroeconomics, bioengineering, or behavioral economics, to take a few examples.

As I look at the recent ups and downs of enrollment at management schools, it’s now time to double-down on the irony. Coterminous with the decline of the traditional two-year MBA program and the uptick in specialized degrees is the amazing increase in interest in Masters in Management (MiM) programs, which are far more attractive in Europe right now than in the U.S. MiMs are given to newly minted college graduates with no work experience and allow students to specialize in just about anything.

The two degrees are strikingly different. With one you get a younger, inexperienced person with a dash of management theory. Most regular, two-year MBA programs provide both experience and the capacity to link together the essential elements of management such as finance, marketing, organizational behavior, and operations.

Which leads me to the title of this blog, “trained incapacity,” a phrase introduced in 1914 by the quirkily brilliant socioeconomist Thorstein Veblen. He reasoned that one’s expertise can function as “blindlessness,” which leads to a skewed and distorted vision of reality. That’s what concerns me about the proliferation of the new management programs, often with M.S. titles. Mastering management, to repeat its significance, means and requires an overview and integration of the many theories and functions of management. Specialized management courses are useful but should come well after the complexity of management and business are understood. This leads to a punch line that makes Veblen’s apt phrase more resonant, from a person of the same era but with an entirely different background.

“I would not give a fig for the simplicity this side of complexity,” wrote former Supreme Court Justice Oliver Wendell Holmes Jr., “but I would give my life for the simplicity on the other side of complexity.”

Join the discussion on the Bloomberg Businessweek Business School Forum.